02 March 2017

Eight in 10 Singapore millennials are optimistic about their lifestyle in retirement – Manulife Survey

- Only five out of 10 are currently on track to achieving their financial goals

- Majority plan to supplement about 20% of their retirement income by continuing to work full or part time

- Investing in property popular among millennials but only 58% of investors satisfied with rental yields

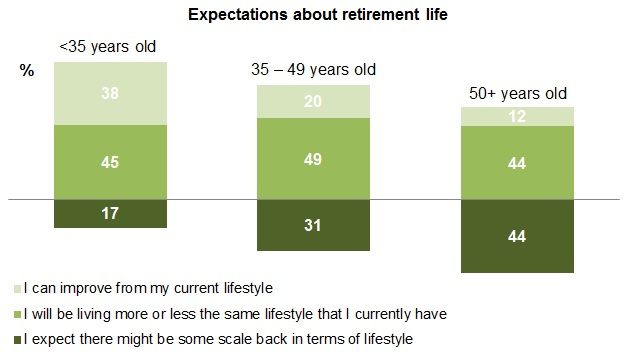

Singapore – Millennials in Singapore are more optimistic about their retirement prospects than older generations, according to new research from Manulife. The Manulife Investor Sentiment Index (MISI)* revealed that eight out of 10 millennial investors in Singapore believe they will be able to maintain or improve on their current lifestyle after they retire. In contrast, older investors tend to lower their expectations as they draw closer to retirement age: 44% of investors above the age of 50 expect to scale back their lifestyle when they retire.

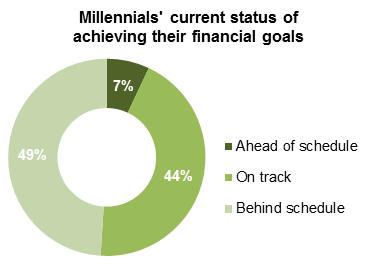

Despite their optimism, many Singapore millennials appear to be falling behind in their plans, even though saving for retirement is among their top financial priorities. Only five out of 10 say they are on track to achieve their financial goals, which is one of the lowest proportions in Asia.

At the same time, many millennials recognise that their retirement aspirations may be challenged by financial and health concerns.

A large majority (74%) plan to continue working in a full or part-time job after they retire, expecting income from work to contribute close to 20% of their retirement income. However, more than half (53%) feel that their health condition may not allow them to continue working, suggesting that part of their retirement income may be at risk.

These millennials may also eventually become the new ‘sandwich generation’, as they find themselves juggling to care for both their children and their aged parents. More than one-third (34%) believe they will need to support their children as well as their parents financially even after they retire, as opposed to only 8% for those aged 50 and above. In addition, 44% do not expect to receive any financial assistance from their children.

Adding on to their financial burden, half of the millennials surveyed expect that they will still be carrying debt or a mortgage in retirement.

Naveed Irshad, President and Chief Executive Officer of Manulife Singapore, said:

"It’s heartening to see that millennials in Singapore are hopeful about their life in retirement, while still having realistic views about the financial and health risks that may be present. When it comes to saving for one’s retirement, the key is to start as early as possible. The earlier you start, the easier it will be to make your retirement dreams a reality. For millennials who feel that they are behind in achieving their financial goals, we are committed to helping them accelerate their progress and plug the gap through our financial advice and suite of retirement solutions."

Investment in property loses shine, with only 58% satisfied with rental yields

The survey also revealed that while many Singapore millennials continue to favour investing in property as a means of financial security, it may no longer deliver the returns they hope for.

Over two-thirds (68%) of millennials in Singapore intend to purchase a local property, with two out of five planning to do so for investment purposes to generate rental income. However, Singapore investors are least satisfied with their rental yields in Asia, with only 58% expressing satisfaction, suggesting that millennials who are banking on this investment option may benefit from seeking other alternatives to avoid future disappointment.

Wendy Lim, Chief Executive Officer of Manulife Asset Management (Singapore), commented:

"Overall in the last decade or so, we have seen yields falling across the board, be it rental, dividend or bond yields and the market has on the whole experienced higher volatility. Against this backdrop, investors should build a diversified portfolio across asset classes instead of depending on one asset class or property alone to achieve their retirement goals."

About Manulife Investor Sentiment Index in Asia

Manulife’s Investor Sentiment Index in Asia is a yearly proprietary survey measuring and tracking investors’ views across eight markets in the region on their attitudes towards key asset classes and issues related to personal financial planning. The Index is calculated as a net score (% of “Very good time” and “Good time” minus % of “Bad time” and “Very bad time”) for each asset class. The overall index is calculated as an average of the index figures of asset classes. A positive number means a positive sentiment, zero means a neutral sentiment, and a negative number means negative sentiment.

The Manulife ISI is based on 500 online interviews each in Hong Kong, China, Taiwan, Thailand, Singapore, Malaysia and the Philippines, and 500 face-to-face interviews in Indonesia. Respondents are middle class to affluent investors, aged 25 years and above who are the primary decision maker of financial matters in the household and currently have investment products.

The Manulife ISI is a long-established research series in North America. The Manulife ISI has been measuring investor sentiment in Canada for the past 18 years, and extended this to its John Hancock operation in the U.S. in 2011 and Asia in 2013. Asset classes taken into Manulife ISI Asia calculations are stocks/equities, real estate (primary residence and other investment properties), mutual funds/unit trusts, fixed income investment and cash.

The latest survey was conducted between September 2016 and October 2016 by TNS, a leading global research firm.

This material, intended for the exclusive use by the recipients who are allowable to receive this document under the applicable laws and regulations of the relevant jurisdictions, was produced by and the opinions expressed are those of Manulife or any of its affiliates as of December 2016 and are subject to change based on market and other conditions. The information and/or analysis contained in this material have been compiled or arrived at from sources believed to be reliable but Manulife or any of its affiliates does not make any representation as to their accuracy, correctness, usefulness or completeness and does not accept liability for any loss arising from the use hereof or the information and/or analysis contained herein. The information in this document, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife or any of its affiliates disclaims any responsibility to update such information. Neither Manulife or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained herein. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife nor any of its affiliates or representatives is providing tax, investment or legal advice. Past performance does not guarantee future results. This material was prepared solely for informational purposes, does not constitute an offer or an invitation by or on behalf of Manulife or any of its affiliates to any person to buy or sell any security and is no indication of trading intent in any fund or account managed by Manulife. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Unless otherwise specified, all data is sourced from Manulife.

For more information on the Manulife Investor Sentiment Index, please visit manulife.com.sg.

About Manulife Singapore

Established in 1899, Manulife Singapore provides insurance, retirement and wealth management solutions to meet the financial needs of our customers across their various life stages. Customers can readily access our solutions through our extensive multi-channel distribution network. In addition to our established agency force, we distribute our products through a number of specialist partners, including banks and financial advisory firms. For more information on Manulife Singapore, visit manulife.com.sg.

About Manulife

Manulife Financial Corporation is a leading international financial services group that helps people achieve their dreams and aspirations by putting customers' needs first and providing the right advice and solutions. We operate as John Hancock in the United States and Manulife elsewhere. We provide financial advice, insurance, as well as wealth and asset management solutions for individuals, groups and institutions. At the end of 2016, we had approximately 35,000 employees, 70,000 agents, and thousands of distribution partners, serving more than 22 million customers. As of March 31, 2017, we had $1 trillion (US$754 billion) in assets under management and administration, and in the previous 12 months we made almost $26.3 billion in payments to our customers. Our principal operations are in Asia, Canada and the United States where we have served customers for more than 100 years. With our global headquarters in Toronto, Canada, we trade as 'MFC' on the Toronto, New York, and the Philippine stock exchanges and under '945' in Hong Kong.

About Manulife Asset Management

Manulife Asset Management is the global asset management arm of Manulife, providing comprehensive asset management solutions for investors. This investment expertise extends across a broad range of public and private asset classes, as well as asset allocation solutions. As at December 31, 2016, assets under management for Manulife Asset Management were approximately C$461 billion (US$343 billion, GBP£278 billion, EUR€325 billion).

Manulife Asset Management’s public markets units have investment expertise across a broad range of asset classes including public equity and fixed income, and asset allocation strategies. Offices with full investment capabilities are located in the United States, Canada, the United Kingdom, Japan, Hong Kong, Singapore, Taiwan, Indonesia, Thailand, Vietnam, Malaysia, and the Philippines. In addition, Manulife Asset Management has a joint venture asset management business in China, Manulife TEDA. The public markets units of Manulife Asset Management also provide investment management services to affiliates' retail clients through product offerings of Manulife and John Hancock. John Hancock Asset Management is a division of Manulife Asset Management.

Additional information about Manulife Asset Management may be found at www.ManulifeAM.com.

Media Contacts

Cheryl Lim

Manulife (Singapore) Pte Ltd

Nora Seah

Manulife (Singapore) Pte Ltd