16 May 2017

Manulife LifeReady: Be healthy and enjoy upfront premium discounts for life

Customers who meet health targets get consistent premium discounts on all premium-paying years

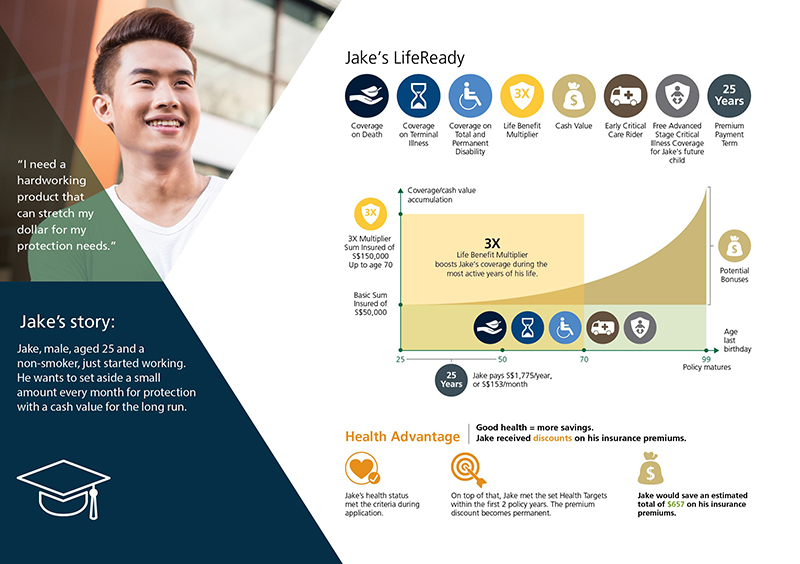

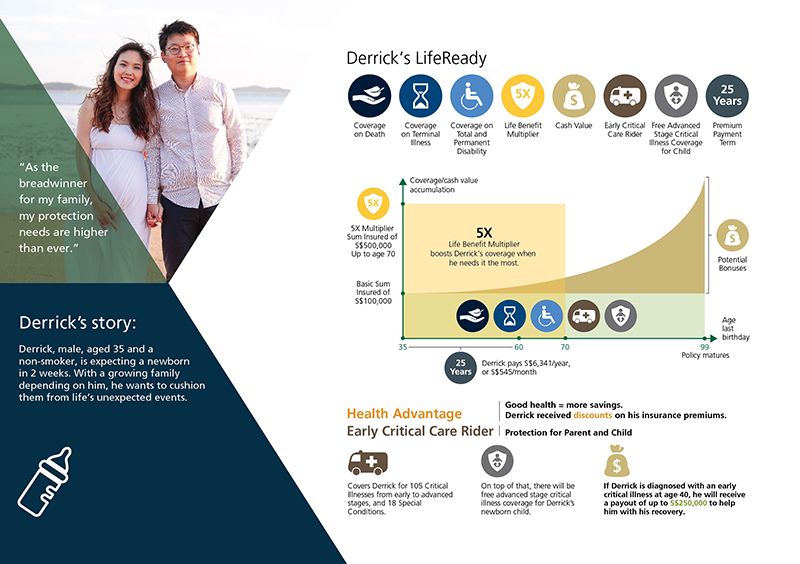

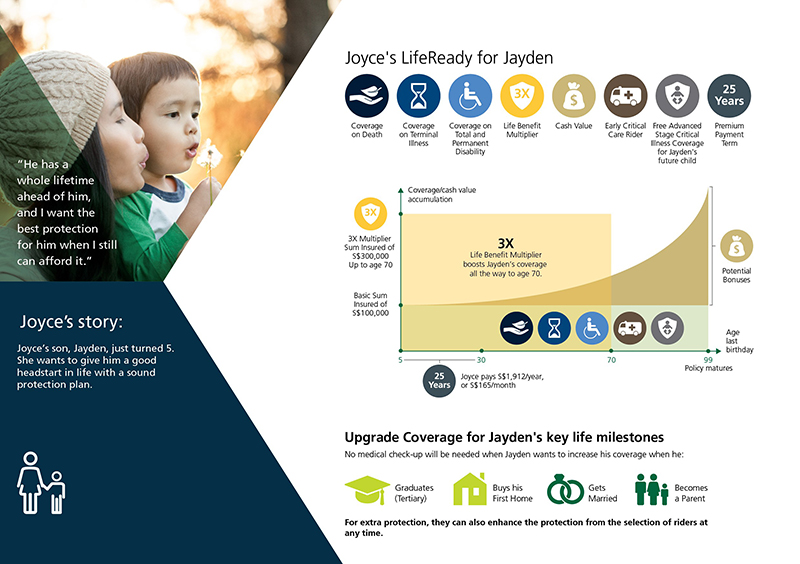

SINGAPORE, 16 May 2017 – With a mantra of constant innovation, and a mission to improve the health of the nation, Manulife Singapore has introduced LifeReady to the market, a first-of-its-kind whole life protection plan with a Health Advantage benefit. This unique feature gives eligible customers hassle-free upfront premium discounts for the first 2 policy years. If these customers do not qualify for the lifetime premium discounts during their initial policy applications, they are given up to 2 years to qualify by meeting a set of health targets – these include Build Mass Index (BMI), blood pressure, and cholesterol level. Once the health targets are met, these customers are further rewarded with premium discounts on the remainder of their premium-paying years.

A double win: by maintaining good health, customers are not just extending their own lives, but are also being rewarded financially for it – once customers qualify for their premium discount benefit, they get to enjoy it for life.

Commenting on Manulife LifeReady plan, Carlos Vazquez, Chief Product Officer, Manulife Singapore said: "We are proud to introduce an innovative plan designed to provide extra rewards for our customers who are currently healthy or are committed to becoming healthier in the near future. Qualifying for our health discount is simple and transparent. This is another example of a Manulife solution helping to drive better customer health and well-being, while also financially rewarding customers for accomplishing their health targets."

LifeReady is also designed to flex based on the customer’s changing needs throughout life. Certain key milestones give customers the freedom to upgrade their coverage by purchasing an additional plan without requiring a medical check-up. These key milestones include graduation, buying a first home, getting married, and having children. In fact, LifeReady’s early CI rider will pay out one of the highest amount per early critical illness claim in the market today.

The LifeReady plan offers its customers a suite of benefits that includes:

Coverage on death

Coverage on terminal illness

Coverage on total and permenant disability to the age of 70

Multiplied protection of up to 5 times

Cash value

Additional riders

Visit our LifeReady webpage for further information, or download the brochure.

About Manulife Singapore

Established in 1899, Manulife Singapore provides insurance, retirement and wealth management solutions to meet the financial needs of our customers across their various life stages. Customers can readily access our solutions through our extensive multi-channel distribution network. In addition to our established agency force, we distribute our products through a number of specialist partners, including banks and financial advisory firms. For more information on Manulife Singapore, visit manulife.com.sg.

About Manulife

Manulife Financial Corporation is a leading international financial services group that helps people achieve their dreams and aspirations by putting customers' needs first and providing the right advice and solutions. We operate as John Hancock in the United States and Manulife elsewhere. We provide financial advice, insurance, as well as wealth and asset management solutions for individuals, groups and institutions. At the end of 2016, we had approximately 35,000 employees, 70,000 agents, and thousands of distribution partners, serving more than 22 million customers. As of March 31, 2017, we had $1 trillion (US$754 billion) in assets under management and administration, and in the previous 12 months we made almost $26.3 billion in payments to our customers. Our principal operations are in Asia, Canada and the United States where we have served customers for more than 100 years. With our global headquarters in Toronto, Canada, we trade as 'MFC' on the Toronto, New York, and the Philippine stock exchanges and under '945' in Hong Kong.